Abstract

Since the inception of the CPA Licensure Examination, it has been one of the more difficult Licensure Examinations to hurdle. In the Philippines, it has been consistently ranked within the Top 10 of the Hardest Licensure Examinations. When Palawan State University was able to send BS-Accountancy graduates to take the licensure exam, it has been difficult for the said CPA candidates to pass the said examination. Studies in relation to the said topic have been done from the accreditation of a school’s accountancy program, the students’ habits, GWA/GPA and other characteristics were made. This study focused on the review period before the licensure examination of the CPA candidates. This study also identified factors that contribute to the success of a CPA candidate. Results show that two-thirds reviewed at RESA. Their preferred review session is the afternoon session. This study also showed that they spend more than 8 hours in the evening to prepare for the examination. They also understood the concept first before proceeding with practical application. The candidates also used self-assessment to evaluate themselves for the examination.

Keywords: BS-Accountancy, CPA, Strategies, Study Habits, Techniques

Introduction

Early evidence of the existence of accounting can be traced 6,000 years ago. Discovery of rudimentary accounting records from temples in Lower Mesopotamia. In 1340, the double-entry accounting were discovered in the “Massari Ledgers” of the Commune of Genoa. This was earlier than Luca Pacioli’s “Summa” which was first published in 1494. Since the Massari Ledgers have little evidence of their validity, the Franciscan Friar and mathematician is still universally recognized as the “The Father of Accounting and Bookkeeping”.

Originating in England, the professional accountancy examinations are now standard in all countries recognizing accountancy as a profession. Candidates wanting to enter the profession must show his or her knowledge and proficiency in numerous accounting areas. The exam continues to evolve with the changing needs of the profession. In the future, the changing business and technological environment will demand higher level of skill set from entry level accountants. In the future, the CPA Examination must be designed to assure the knowledge, ability, and skill of the candidates taking the exam, so that the public will be protected and accountancy remain a respected profession (King, D. L., et al., 2017).

In the early 1900’s, the accounting profession realized the need of quality education and accounting work experience. The American Association of Public Accountants (AAPA), the precursor of American Institute of Certified Public Accountants (AICPA), realizing this necessity, developed a uniform CPA exam as an admission requirement to the profession. The giving out of uniform examinations has been adopted in the Philippines and all over the world before one may be admitted to the profession, although examinations may vary and additional requirements such as number of years of related experience may be necessary for admission.

A study reveals that practitioners support (1) setting national uniform requirement for education and job experience, (2) requiring college-level course(s) in ethics, and (3) requiring candidates to have courses in specific areas of accounting and non-accounting disciplines (Demagalhaes, et al., 2014). A study also suggests that auditors with Professional Accounting Education (PAE) background possess higher competency compared to those without. Supervisor, manager, and partner perceptions are better for those subordinates with PAE background. Further, findings supported to a certain extent that PAE has a significant role in enhancing professionalism in auditors (Utami, et al., 2011).

College accounting curricula have always stressed public accounting and the CPA exam. But with the emergence of new certification programs, potential accountants have a wide choice of professional designations to differentiate themselves. Despite the competition, the CPA is still the best recognized brand name among accounting students. But the CIA, CFE, and other certifications are catching up with and in some aspects surpassing the CMA recognition (Brody, et al., 2016).

Consistently, the Certified Public Accountant (CPA) Licensure Examination has been always ranked in the Top Ten Hardest Licensure Examination locally and abroad. In the Philippines, the Board of Accountancy (BOA) conducts the examination twice a year. Data from the Professional Regulation Commission (PRC) revealed that the highest exam passing percentage is 48% never hitting the 50% mark.

Since Palawan State University was able to produce accountancy graduates, it has consistently produced CPA Licensure Examination passers above the national passing percentage. There was always a retention policy but it was not strictly implemented during the late 1990s. The adverse result of non-implementation was when the university’s passing rate became lower than the national passing percentage. The lowest point was in the early 2000s when the university at times had no passers in the licensure examination.

The Uniformed CPA Examination is an objective measure that can be employed for evaluation purposes and that accrediting organizations should require disclosure of each accredited school’s UCPAE passing rate as requirement for accreditation. Further, findings also indicate that faith-based CCCU member schools performance is significantly higher than for-profit schools. This is attributable to small class sizes, active learning methods and additional mentoring by faculty at CCCU member schools (Hahn, et al., 2015).

Several studies were made to identify techniques and strategies of successful CPA Licensure exam passers, as well as factors surrounding success in hurdling the said examination. This research focused on external factors such as the review school, habits, techniques and strategies during review.

The objectives of this study are to know (1) the review school the successful CPA examinees enrolled in and what is their schedule; (2) the time of the day and the number of hours the successful CPA examinee study; (3) the number hours the successful CPA examinee sleeps; (4) the techniques and strategies that successful CPA examinee used during the preparation for the licensure examination; and (5) how did the successful CPA examinee assess his/her readiness to take the CPA Licensure Examination.

Methodology

Design

The research used descriptive quantitative method of research. It described the factors contributing to the success of PSU’s CPA Licensure Exam candidates covering the period from 2013 to 2017. It was conducted with graduates of Palawan State University who successfully passed the CPA Licensure Exam covering the period from May 2013 to October 2017. The respondents will be the total population which were the successful passers of the CPA Licensure Exams for the said period.

Population

The participants of this study are the successful candidates of the CPA Licensure examination covering the period from May 2013 to October 2017. The questionnaires were distributed to 108 CPAs who successfully passed the CPA board examination in the said period. Out of the total population, 55 or 51% replied.

Data Collection

A survey questionnaire was distributed to the respondents. The said questionnaire was sent thru Google Survey and Facebook to all respondents including those located outside of Puerto Princesa City and Palawan. The list of respondents was acquired from the records of the Department of Accountancy of Palawan State University. To summarize the results of the data gathering, tables and figures were used.

Statistical Analysis and Variables

Data were analyzed using the descriptive statistics embedded in the IBM Statistical Package for the Social Sciences (SPSS) Version 19. The study used the frequency count percentages to describe the responses. The frequency count was used to find out the number of responses given to a particular question. Percentages were used to convert the frequency counts. As for the other data, tables and figures were used to show the results of the data gathering.

Results

I. No. of times took the CPA Licensure Exam

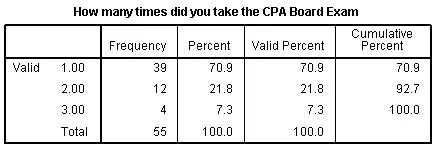

The descriptive statistics below show 55 valid responses with no missing entries or respondents. As illustrated below, a great majority (n = 39, 70.9%) of them took the CPA Licensure Examination once, (n = 12, 21.8%) took the exam twice, and the remaining (n=4, 7.3%) took the examination thrice.

Table 1. Number of times the CPA board exam was taken.

thnx for the comments. its gud to know i could be of help to u readers.