How do you manage your finances? Do you realize that you can use research tools in effectively managing it? Read the article below and be victorious in handling your monetary affairs.

Some people find it difficult to keep themselves free of financial concerns. Many of these difficulties lie in the kind of lifestyle that people adopt in their daily lives. But what kind of lifestyle do you have and how does this impact to your financial status?

There is no generic way to describe what really transpires in one’s financial life unless an objective approach is applied to examine it. It may be that you believe you are doing just fine. It’s just the circumstances around you that make it difficult for you to make ends meet.

Most of us have this inclination, we tend to believe what we perceive. But we could be wrong in this presumption. For this reason, doing a little research and using research tools can empower you to help you manage your finances better.

How can research tools be used in handling your money? Here are the things you can do to see things clearly and apply the correct approach to bring you out of perennial debt.

1. Use graphs to look at how you spend your money

You cannot really say you understand fully your spending behavior unless you list down where your money goes. Every time you buy something, take time to record the transaction into a notebook dedicated for that purpose. Don’t be tempted to use an electronic media as you will tend to lose it if for any reason viruses attack your computer. Your expenses are not also visible and easily accessible to you. If you have a hard copy, you can grasp it at an instant.

Do your recording consistently for one month and graph your expenses at the end of the month. This is easily done using a spreadsheet application such as Excel or Open Office Calc. The best graph for this purpose is a bar graph. Those that you spend most will rise above the rest of your expenses. Look at the three highest bar and contemplate if you can still bring them down or make a little adjustment.

2. Get a good, objective perspective to guide your thinking

Many people believe that they need everything they spend on. Wants may actually be viewed as needs by different persons. For example, having the latest high-tech cellphone satisfies the need to interact with the latest technology. That could be considered a need if that itself satisfies a person and he has the means to acquire it. But for a person who does not have the means, it will be just a luxury. So, the classification of needs and wants ultimately lies in the eyes of the one concerned.

Adopt a perspective that suits your present financial capacity. Don’t fall into the trap of keeping up with the Joneses because the Joneses live luxuriously. You do not know the real score behind their way of life. It may be that they are in a quagmire of debt.

3. Use a theoretical framework to prioritize your needs and wants

What needs do you really have to fulfill? You can reflect on Maslow’s Hierarchy of Needs to have a better idea where your belief stands. For example, the basic need at the very bottom shows that people need to breathe fresh, clean air; drink clean water, wear appropriate clothing to warm the body or keep it from the elements, and get a good sleep. These needs must be satisfied first before going up the next level. The other items towards the top describe the higher level needs when all the needs below are satisfied.

Why use this theoretical framework by Maslow? A theoretical framework sums up, in a most critical way, the results of many studies. For this reason, the framework represents what you really need to fulfill.

4. Satisfy all your needs first before your wants but first define what is a need and what is a want

In research, you need to be clear with what terms you are using. Is your definition of need clearly distinguishable from want? What is really a need? How about the want?

The rule is you need to satisfy first your needs before your wants. This is just fair because needs are designed to be fulfilled mainly for survival, while wants can be done without. Wants can be ignored. This is the reason why many advertisements always appeal to one’s vanity to get products across which, actually, are not vital to one’s survival.

Needs and wants, therefore, can be defined thus:

- Needs. These are goods (and/or services) that are vital to one’s very survival. Non-satisfaction of these needs lead to loss of life.

- Wants. These are goods (and/or services) that one can avail to enjoy but can live without.

Notice that ads are trying to make you believe that the things they sell are really your needs. But if you ask yourself if you really need those things to survive, chances are, the answer is “not at all.”

5. Systems Thinking: Don’t spend more than you can earn and spend the minimum possible

Adopt a systems thinking in managing your finances. What comes in must equal what comes out. Don’t put out more than what comes in.

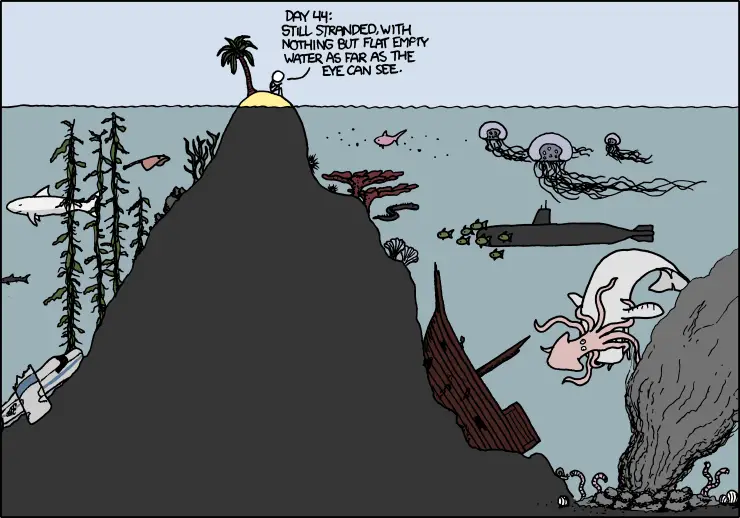

Imagine yourself stranded in an island surrounded by sharks where your only means of survival are goods that come your way from a sunken ship. Your consumption will entirely depend on what goods land on the island. Your best strategy to survive is to live on the smallest amount to keep you alive each day and for a long time.

If you have a credit card, this is one way that you will spend more than you can actually earn. Spend less than what you earn. If you want to spend more, earn more. This is just a matter of discipline. If you don’t have discipline, don’t use a credit card. Always pay your credit on time to prevent being buried in debt. Stay within your credit limit and don’t increase your credit limit if you are not able to pay your debts on time.

Lastly, what matters most is application. Whatever things you learn but unable to apply will be for naught. Take action and manage your finances well.

© 2013 December 7 P. A. Regoniel